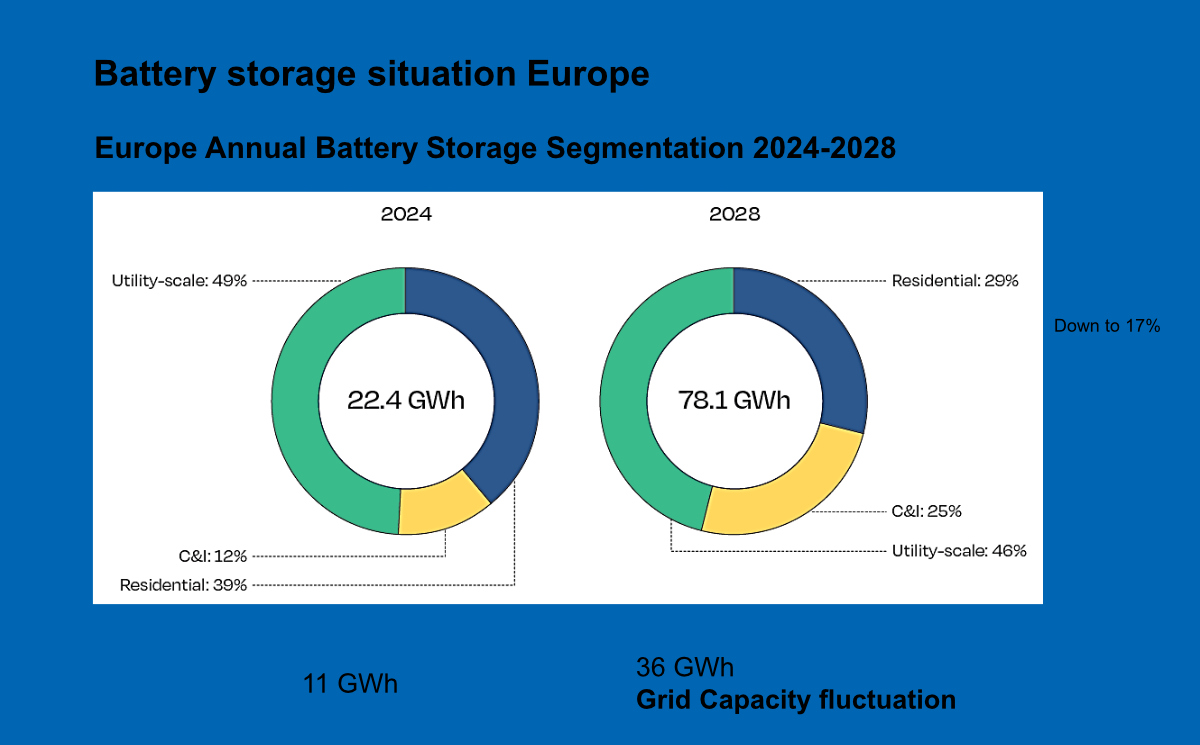

Germany targets around 100 GWh of grid-scale battery storage by 2030 alongside 200 GW solar — creating a deep, bankable pipeline. According to Fraunhofer ISE and the Europe Battery Storage Outlook 2025, Germany alone will require between 95–104 GWh of large-scale battery capacity by 2030 to stabilize its renewable-heavy grid — an opportunity exceeding €25 billion in investment value. We deliver EU-compliant, bankable Battery Energy Storage Systems combining European project leadership with reliable Asian technology partners.

Our core team has over 50 years of combined experience in large-scale energy and technology across Europe and Asia.

Direct involvement in multiple 250 MW / 680–800 MWh BESS projects in Germany and partnerships with:

– TSOs: TenneT, Amprion

– DSOs / Utilities: RWE, E.ON, EnBW

– Technology partners: Siemens, SMA, EVE, Tecloman, Wenergy, BYD, Renopoly

– EPC / Grid works: Eiffage, Leonhard Weiss

These ties de-risk execution and scale.

EU grid & safety compliance: VDE-AR-N 4110/4120, EN 50549, IEC 62933.

Technical: ≥ 10-yr OEM warranties; TÜV-verified monitoring.

Grid: Type tests incl. FRT, black-start capability, FAT/SAT certified.

Regulatory: BImSchG processes embedded (env. & fire protection).

Market: Stacked revenues (FCR/aFRR, arbitrage, redispatch) with floor/CPA options.

Financial: Fixed-price EPC, OPEX 2–3 % of CAPEX, comprehensive insurance.

Typical 10 MW / 20 MWh project volume ≈ €8.5 m.

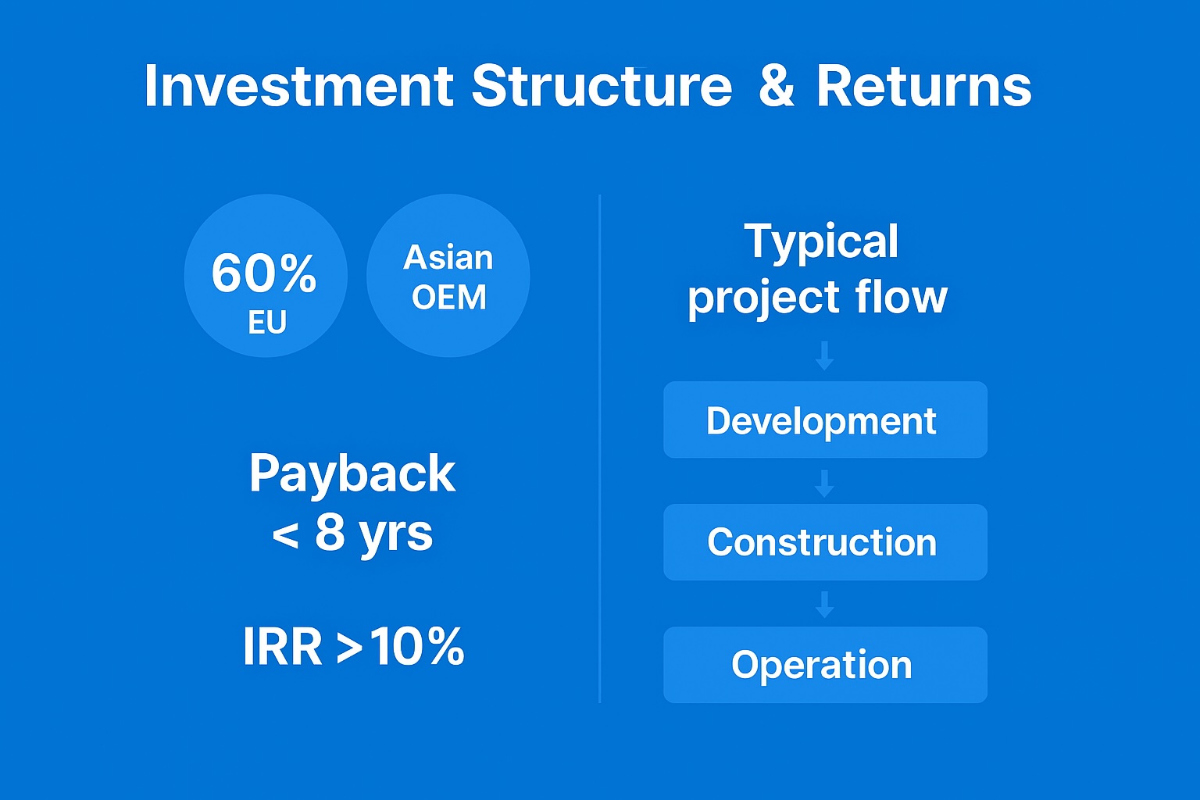

Equity: 60 % EU lead investor + 40 % Asian OEM (strategic, containerized BESS).

Revenues: FCR/aFRR, arbitrage, redispatch; hybrid PPA & aggregator floor models.

Returns: Payback < 8 yrs (conservative), IRR > 10 % with hedging.

Exits: BOT at COD, BOO for yield, or secondary sale (Yr 5–7).

We provide the technical & organizational backbone from development to O&M — bankable engineering, utility-side credibility, and a growing EU pipeline.